The London based brokerage-ICAP, has been fined £55m by regulators with three of its former employees facing criminal offence charges in the United States. ICAP has been under investigation by regulators for allegedly manipulating the Libor rate, the global benchmark on which trillions of mortgages and loans are set.

|

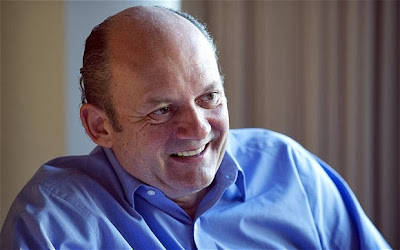

| Michael Spencer, chief executive of ICAP, which has been fined £55m for its role in the Libor-rigging scandal |

How the Libor is currently set

Libor – the London interbank offered rate– is a benchmark rate computed based on submissions of rates by a number of leading banks for 10 currencies and 15 lengths of loan, ranging from overnight to 12 months. In each case, the four highest rates and the four lowest rates are ignored. The average of the remaining rates makes up the Libor rate. Libor is embedded in more than $300tn (£192tn) of financial contracts, derivatives and loans.

How the Libor was manipulated

According to the US Department of Justice, one of the former employees-known as “Lord Libor”- distributed a daily email to individuals outside of ICAP, including derivatives traders at several large banks. The email contained "SUGGESTED LIBORS", purported predictions of where yen Libor ultimately would fix each day across eight specified borrowing periods.

Criminal Offence Charge

Each of the three former employees face a maximum penalty of 30 years in prison if convicted for charges filed against them by the US department of justice (DoJ). They have been charged with conspiracy to commit wire fraud and two counts of wire fraud.

Recent Libor-rigging Scandals

The £55m penalty is a relatively modest sum when viewed in the context of the fines imposed on three other financial institutions-Barclays, Royal Bank of Scotland and UBS- which have settled with regulators over Libor. Last year, Barclays was fined £290m by British and US regulators for manipulation of Libor and Euribor interbank rates between 2005 and 2009. Royal Bank of Scotland just over £390m and UBS just over £1bn on similar issues.

Reference Links:http://www.theguardian.com/business/2013/sep/25/icap-fined-55m-pounds-libor-rigging-charges-former-staff

http://news.sky.com/story/1146297/libor-scandal-icap-fined-amid-criminal-probe

http://www.dw.de/eu-to-tighten-control-of-benchmarks-in-wake-of-libor-scandal/a-17098153

http://www.bbc.co.uk/news/business-22871584

http://www.managementtoday.co.uk/go/news/article/1213541/libor-scandal-claims-its-latest-victim-icap-coughs-55m/

http://www.telegraph.co.uk/finance/libor-scandal/10333655/ICAP-fined-55m-over-Libor-rigging-scandal.html

http://uk.reuters.com/article/2013/07/29/usa-libor-philadelphia-lawsuit-idUKL1N0FZ16620130729

0 comments:

Post a Comment